In my last post I examined the global importance of Unicorns. Compared to small firms (mice), fast growing midsized companies (gazelles) and large firms (elephants), Unicorns define our future. Of the animals in the Kingdom none are doing very well at present. The small firm sector (mice) has been in decline for decades as the service sector has matured, and large firms are in a fight for their life as the internet continues to expand. Think of Walmart, a brick and mortar juggernaut that is losing money to online companies like Amazon.

Where are the Unicorns making their mark in the economy? The answer to that question goes a long way towards explaining everything from stagnant productivity in the United States to a stagnant global entrepreneurial ecosystem.

First, the 15 technology companies with the largest market capitalization in 2000 have been devastated, losing about $1.35 trillion, of their combined market value. Only one, Microsoft, has a market capitalization that is higher now than in the year 2000.

The most interesting aspect of this meltdown is that it affected what was once considered blue-chip technology holdings. In 2000, Nortel sported a market value of $200 billion; Cisco’s market value has faded from $403 billion to $144 billion, Intel’s from $288 to $161 and EMC’s from $218 to $51 billion.

These declines were in systems, hardware and semiconductors. This is a result of the continued decline in the cost of computing, the rise of open source computing, the move to the cloud and the emergence of huge datacenters where companies such as Amazon, Google and Facebook are designing their own approaches.

Second, fifteen companies that were together worth less than $10 billion in 2000 are now among the world’s 50 top technology companies as measured by market capitalization, with a combined worth of $2.1 trillion. Several of today’s most valuable technology companies did not even exist in 2000. Facebook, LinkedIn and Twitter together have a collective corporate history of only 33 years. These companies now have a combined value of about $850 billion.

Right below this is a group of companies ranked fourth, fifth and sixth most valuable technology companies are Alibaba, Tencent and Baidu. This threesome is now worth $409 billion. This shows how China has progressed in the last decade and a half and is a wakeup call to the future power of China.

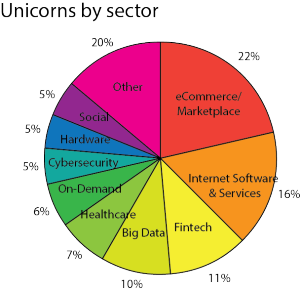

A look at the Unicorns in the world shows that they fall into ten categories. The most important industry segment almost a quarter of the firms are in eCommerce/Marketplace. Amazon leads the pack here as well as Alibaba. The next largest segment is in Internet Software and Services, Dropbox and Spotify for example. Similar to these next-generation segments is big data, including Palantir Technologies and Cloudera. These three segments make up about 50% of the global unicorns.

Smaller numbers of unicorns belong to a set of industries that are in transition between traditional approaches and a digital world. These include financial technology companies (Stripe), healthcare (23andMe) and education (TutorGroup). Finally, some new sectors, social media (Pinterest), cybersecurity (AVAST) and hardware (Jawbone) support the new technologies.