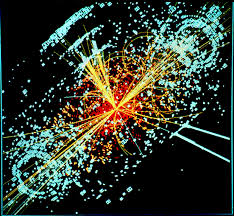

The Higgs boson, an elementary building block of modern physics, was first conceptualized in 1964 and its existence only confirmed in 2013. The search for the Higgs boson consumed the efforts of a generation of scientists. For economists, the inability to explain much of the cross country variation in output by inputs, termed the Solow residual, has been similarly consuming. Solow in 1957 in attempting to explain economic growth could only account for about 13% of variation through the factors in his growth theory; the remaining residual accounted for 87 percent, and this 87 percent of growth still has economists hunting. To resolve this puzzle is important because what lies behind the residual is presumed to be both a building block of the modern economy and essential to economic growth.

The Higgs boson, an elementary building block of modern physics, was first conceptualized in 1964 and its existence only confirmed in 2013. The search for the Higgs boson consumed the efforts of a generation of scientists. For economists, the inability to explain much of the cross country variation in output by inputs, termed the Solow residual, has been similarly consuming. Solow in 1957 in attempting to explain economic growth could only account for about 13% of variation through the factors in his growth theory; the remaining residual accounted for 87 percent, and this 87 percent of growth still has economists hunting. To resolve this puzzle is important because what lies behind the residual is presumed to be both a building block of the modern economy and essential to economic growth.

Solow acknowledged that only a part of economic growth was due to increasing capital and labor inputs; the remainder was caused by technological change. But explaining the determinants and measuring technological change, like the Higgs boson, has proven to be elusive. Understanding what would explain the Solow residual has stimulated much research: ideas have included human capital (education), research and development, patents, and industry structure.

The original notion of inputs generating outputs through an aggregate production function has been extended by more sophisticated measures of inputs, and more complex conceptualizations of the functional relationship and the factors underlying it. While it has not been difficult to explain how past knowledge creates new knowledge (standing on the shoulders of giants) it has been hard to find a strong relationship between the stock of knowledge and total factor productivity: “/…/ the long-run impact of the knowledge (patent) stock on TFP is small: Doubling the stock of knowledge is estimated to increase TFP only 10 percent in the long run. In other words, the results suggest that while R&D scientists and engineers greatly benefit from the knowledge and ideas discovered by prior research, the knowledge they produce seems to have had only a modest impact on measured total factor productivity (Abdih and Joutz, 2006, p. 244).” [1]

So where do we look? In a recent paper we suggest that the answer lies in agency and the institutional structure of the society. Efficiency had first been linked to entrepreneurship by Schumpeter; and that idea was developed by Liebenstein with his theory of X efficiency. More recently North stressed the importance of institutions in creating the incentive structure and the role of entrepreneurship to carry out the creation of new combinations of factors. In other words, new knowledge has to be turned into economic knowledge, and that requires entrepreneurs and a suitable institutional structure that generates and supports agency.

How do we know this? In a rather little cited paper by Marshall Goldman we have a clue. Goldman replicated, more or less, the Solow results for the Soviet Union. What was different between the Soviet Union and the United States was not so much in the development of new technology but in the institutional structure. Goldman estimated that while the residual in the U.S. was around 87 percent, in the Soviet Union it was in the range of 20 percent. In other words, in the Soviet Union, capital and labor explained most of economic growth. Goldman predicted a decline in Soviet growth rates because neither capital nor labor alone could replicate the results from the past.

We therefore propose that the combination of agency and institutions represent the “missing link” in knowledge based growth models. The stronger the institutions, the more productive will be entrepreneurship, and the greater the impact of entrepreneurs on growth. Entrepreneurs are the agents that, by commercializing innovations, provide the transmission mechanism transferring advances in knowledge into economic growth. However, even where entrepreneurial initiative is present, this process of transmission may be either hampered or facilitated by the institutional environment. The idea that institutions are pivotal in explaining the variation in economic growth, not accounted for by changes in factor inputs, was further analyzed by Acemoglu and Robinson and was extended explicitly to consider the inter-relationship between institutions and entrepreneurship by Baumol.

Baumol argues that, even if all counties had similar supplies of entrepreneurship, economic growth and performance would differ as a consequence of heterogeneity in institutions and, as a consequence, the national incentive structure: countries with weak institutions will not create productive entrepreneurship but rather either unproductive or even destructive entrepreneurship. Because the Soviet Union had weak market supporting institutions and poor incentives for wealth-creating entrepreneurship, much of its entrepreneurship was of the unproductive or even destructive type. Indeed, in the Soviet legal code, entrepreneurship of the productive type was seen as criminal activity.

The GEDI approach considers agency and the institutional context jointly to identify the role of the national entrepreneurial ecosystem (NEE) in economic growth. By NEE we mean the dynamic institutionally embedded interaction between individuals characterized by entrepreneurial attitudes abilities and aspirations, which drives the allocation of resources through the creation and operation of new ventures. We show that a measure of NEE can shed light on the hitherto unexplained part of variation in economic growth. This is a different version of the Solow residual, because the original was based exclusively on time series whereas we concentrate on cross country as well as inter-temporal differences.

Yet extending the perspective is critical: cross country variation is necessary to understand the heterogeneity in NEE, and therefore to understand the determinants of growth. In our recently released discussion paper, we estimate a growth model similar to that of Solow for a cross section of 66 countries between the years 2006 and 2010.[2]

[1] Abdih, Y and Joutz, F., (2006). Relating the knowledge production function to total factor productivity: An endogenous growth puzzle, IMF Staff Papers, 53(2), 242-271.