In my last blog I wrote about the character of entrepreneurial ecosystems and consequent policy challenges. I made the point that entrepreneurial ecosystems really do share a number of characteristics in common with natural ecosystems, such as emergent properties (called ‘ecosystem services’), cascading effects, centrality of localised, embedded interactions, dynamic properties, and ecosystem inertia.

I also promised to elaborate what all of the above means for entrepreneurial ecosystem management. But before I get to this, I want to address another source of confusion: the difference between entrepreneurial ecosystems and business ecosystems.

Similar to entrepreneurial ecosystems, a lot of people today talk about ‘business ecosystems’ without defining what they actually mean. This is problematic, because business ecosystems are a hugely diverse phenomenon. They are also fundamentally different from entrepreneurial (or start-up) ecosystems – although the two frequently overlap.

The key to understanding business ecosystems is the concept of leverage[1]. Simplistically put, leverage means that mechanisms exist to generate an output that is disproportional to the size of the input. In other words, through leverage, you get more than you deserve. I hope I have your full attention now.

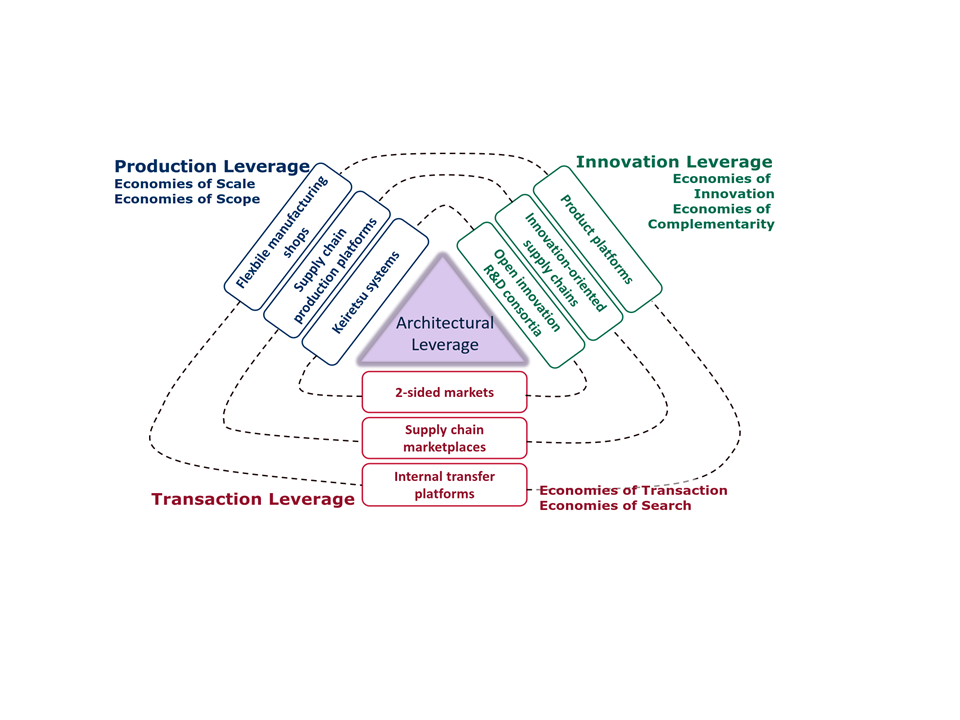

So, how do business ecosystems create leverage? My research suggests there are three basic types of leverage: innovation, production, and transaction leverage. Innovation ecosystems exploit innovation leverage by facilitating economies of discovery and innovation. The result is more innovation for the same input. Think about ‘open innovation’ here. Open innovation communities can accelerate innovation tremendously. Just ask MySQL or Linux.

Then there are manufacturing ecosystems. These leverage modular product platforms, whose open interfaces enable easy connectivity, and therefore, component innovation. Did you know that the low-power Bluetooth today underpins over $30Bn of product sales? Or, more traditionally, think about how the Microsoft PC architecture facilitated the creation of an entire cohort of industries, from memory devices to displays to input devices – to cite a very small fraction of the whole. Modular product platforms encourage component innovation and specialisation, enabling even highly specialised manufacturers to achieve economies of scale through interconnectivity.

Finally, there is transaction leverage, which is achieved through economies of search and transactions. In particular, two-sided marketplaces that connect supply and demand can drive down both search and transaction costs, and they are a key driver behind the sharing economy. As search and transaction costs are minimised, previously under-utilised resources (such as pre-owned design clothes) can be brought into the realm of economic transactions. Think about eBay and Amazon here. For more modern examples, think about Uber or Airbnb.

The three forms of leverage can come in any combination – which explains the huge diversity of business ecosystems. And, business ecosystems can evolve from emphasising one type of leverage towards emphasising another. But, again, the key to understanding any given ecosystem is recognising the leverage it exploits.

Ok, so where does all this leave us? I began by pointing out that business and entrepreneurial ecosystems are different. The discussion above suggests how. Whereas entrepreneurial ecosystems allocate resources to productive uses through the creation (or not) of innovative and high-growth new ventures, business ecosystems create value through leverage – innovation, production, or transactional. This implies that the ‘ecosystem services’ created by the two kinds of ecosystems are different. Entrepreneurial ecosystems create new organizations – a highly complex social process. Business ecosystems create leverage – either innovation, production, or transactional. Whereas entrepreneurial ecosystems tend to be localized, business ecosystems can exist virtually within the Internet. To facilitate entrepreneurial ecosystems, you need to facilitate multipolar coordination and socially projected trust, as communicated through appeal to higher-order shared goals. To facilitate business ecosystems, you need to drive technology platforms – be they innovation-oriented, manufacturing, or transaction platforms.

The above suggests that entrepreneurial and business ecosystems require different policy approaches. In my next blog I will (I promise!) elaborate policy approaches to facilitating entrepreneurial ecosystems. Because business ecosystems are far more diverse, thinking through policy implications is more challenging, but I hope to be able to offer some initial thoughts soonish.

[1] For an elaboration of this concept, see: Thomas, L., Autio, E., Gann, D., 2014. Architectural leverage: Putting platforms in context. Academy of Management Perspectives 28, 198–219.

Nice article , must read other article on entrepreneurship @ http://www.lifeofentrepreneur.net

[…] E. (2015b). Entrepreneurial and business ecosystems: What’s different? December 10, 2015. http://thegedi.org/entrepreneurial-and-business-ecosystems-whats-different/ Ali-Yrkkö, J., & Rouvinen, P. (2015). Mitä arvoverkostojen globalisoituminen merkitsee […]